Objectives of a Price Management System

- Quick identification of products that require price interventions

- Identify and define the decision – making context

- Decision support to immediately compare with old prices in terms of discount, margin impact, etc.

- Save decisions and context, including an expiring date for the new price (or the recommended date to review the impact of the price change on trading & inventory results)

- Immediate integration of new pricing decisions

- both in the analysis system, to avoid redundant analysis ,

- as well as transfer the new prices in the systems that will apply or enforce the new prices

(like ERP/ SFA/ e-commerce/ market places/ etc.)

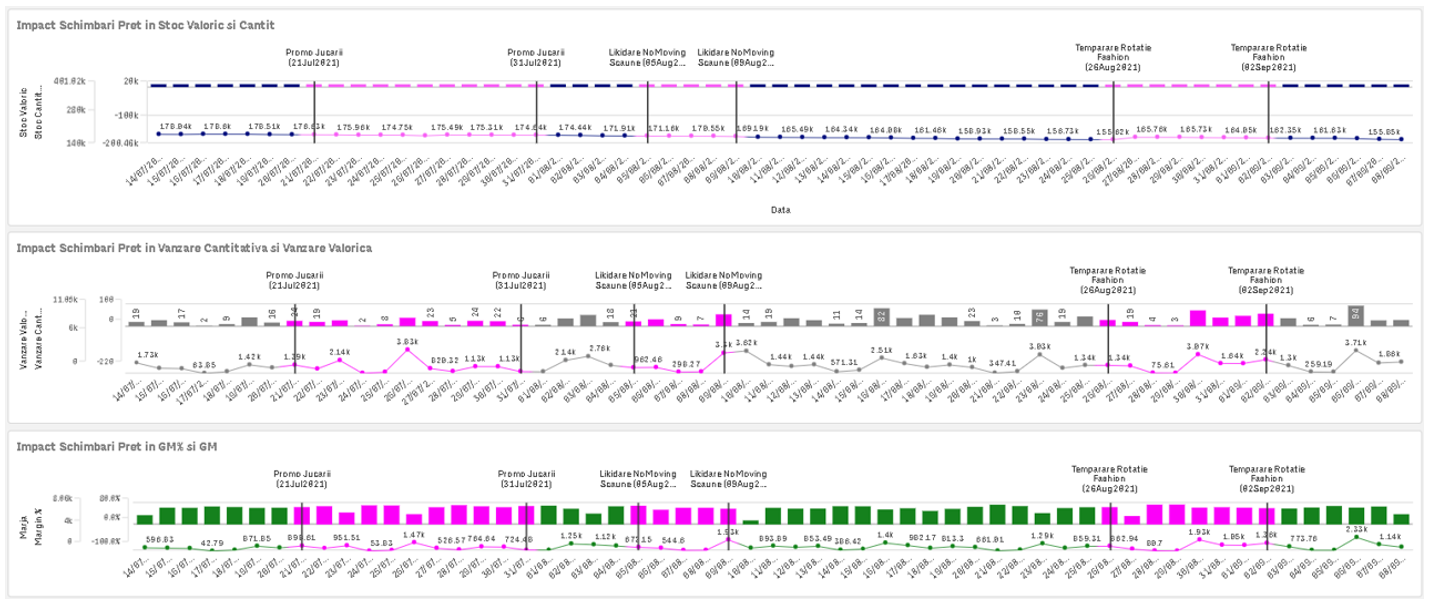

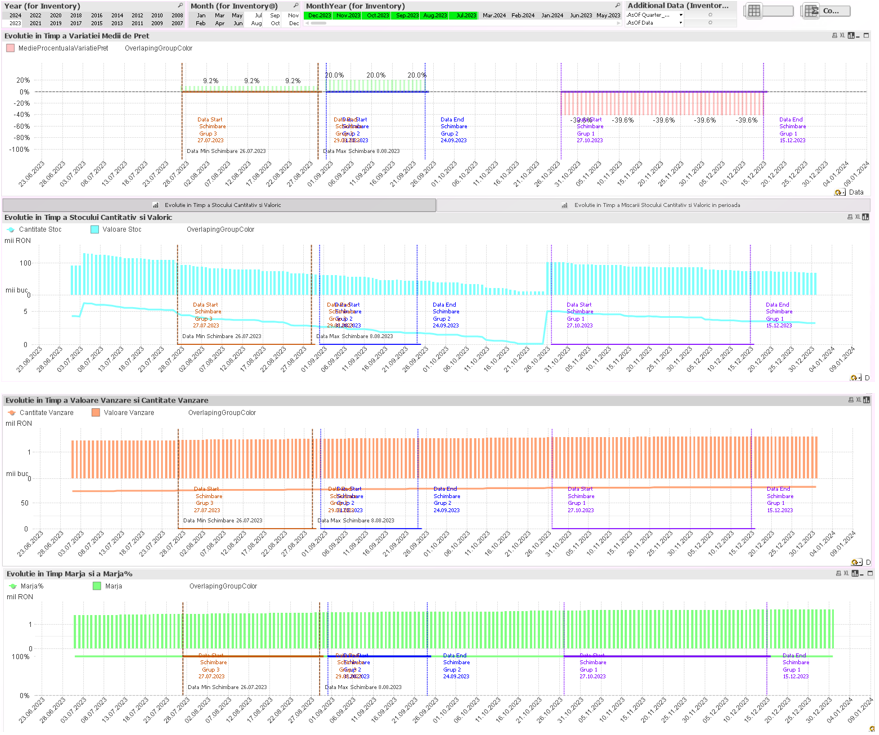

- Check on defined intervals (or whenever necessary) the price change impact in the relevant performance indicators (quantitative and value sales, margin, inventory and inventory days, etc.)

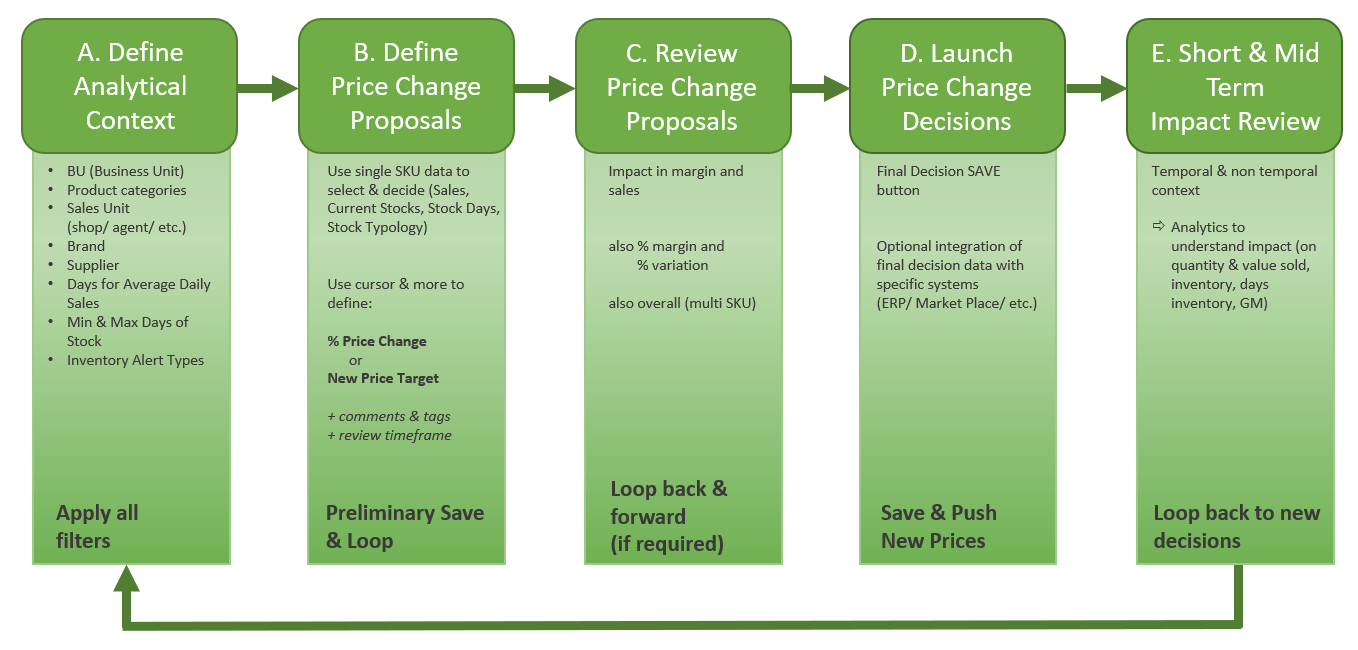

QQpricing™ Operational Flow

Dynamic Price Change Interface

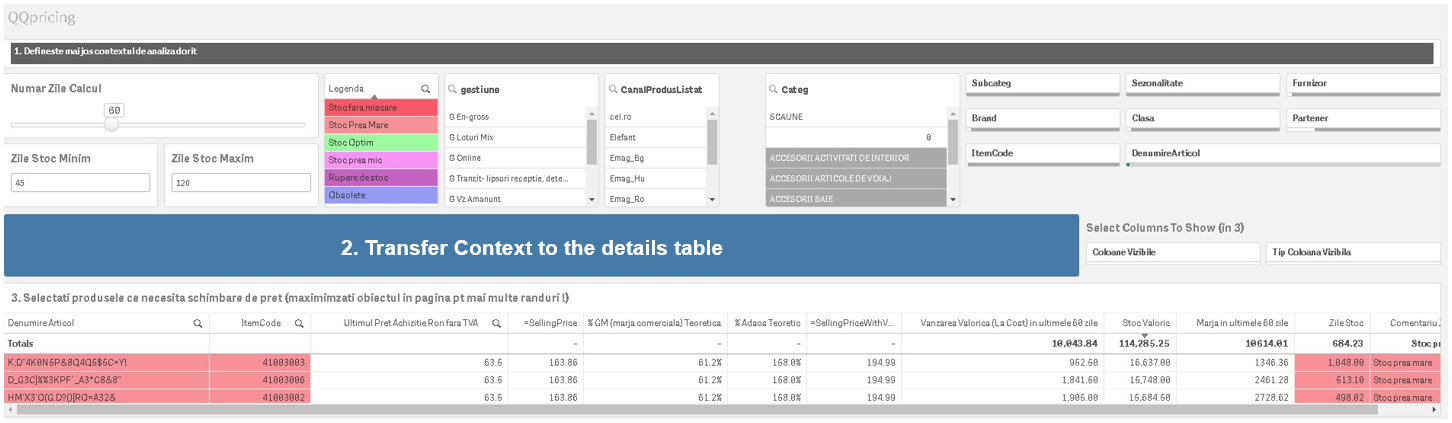

Stage A above includes 3 steps to be executed in the interface:

1. Choosing the context of QQpricing™ decision to be make

2. Transfer the context to the table with preliminary details per product

3. Selection of products for which a similar price correction is desired (percentage change, new price or price change)

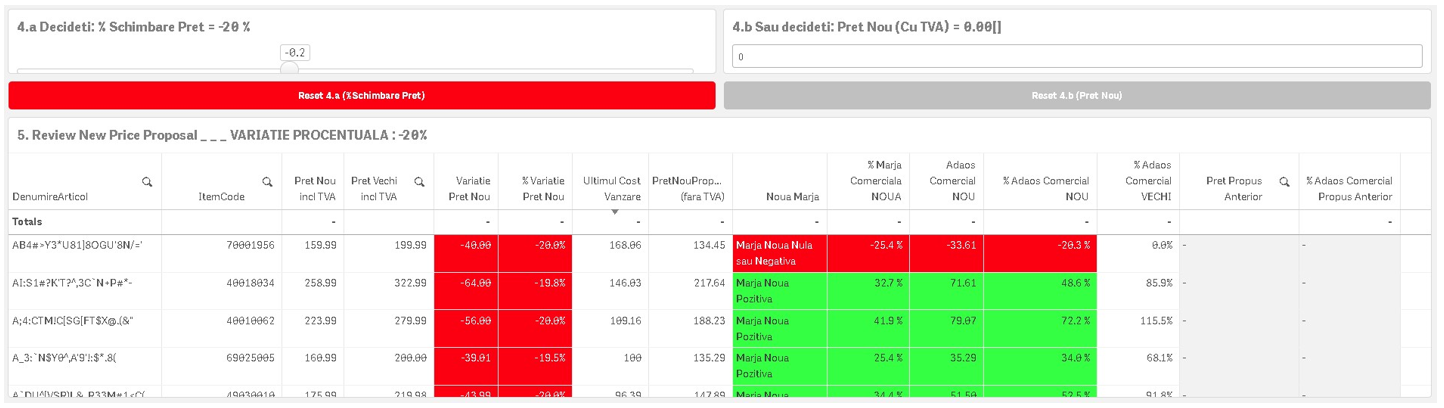

Stage B includes other 2 steps in the QQpricing™ interface:

4. Defining the price change for the selected products

You can choose from several approaches:

- percentage change

- new price

- or price change (coming soon)

5. Immediate impact analysis in price and profitability for each product.

To be noticed that the price change automatically rounds to the next value by .99 to decimals.

(If required)

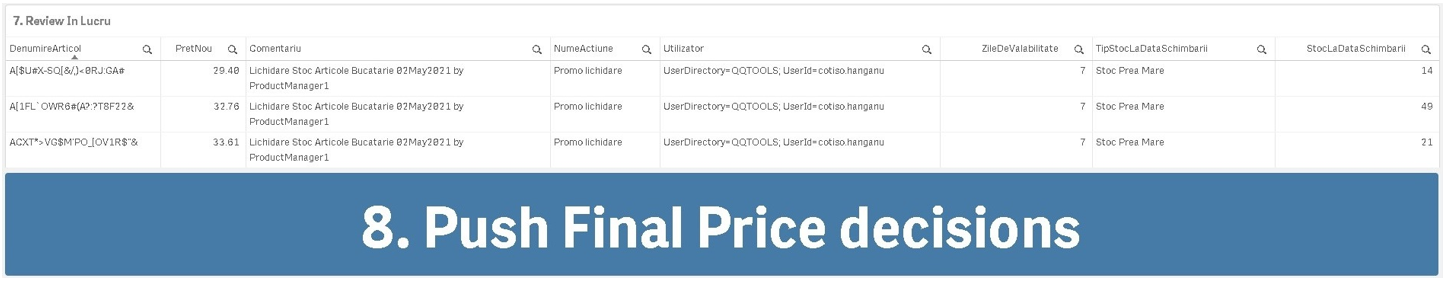

In Stage C, action 6 saves the current price decision in a temporary area, next to other SKUs price change proposals, with dedicated comments and classifications required for a better understanding of that price decision in both in the final approval moment of these price changes and in the future.

In Stage D the next 2 steps take place:

7. Analysis of prepared price change sets, before they are launched (if necessary, you can go back to the previous steps and redefine the desired price changes).

8. The button of sending the final decision of the price changes triggers the saving of all parameters (both the starting context and the decisions, plus comments, explanations, classifications and validity/ revision term of each price change).

Simultaneously, the new prices are sent to all destination systems: ERP/ SFA/ MarketPlace(s)/ etc., being ready in the formats specific to each such destination system.

In addition, depending on the desired level of integration, the system can also take on the task of automatically loading new prices into the target systems.

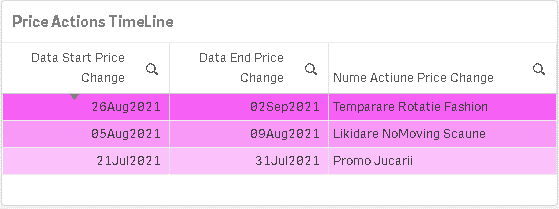

Interface for Reviewing the Subsequent Impact of Price Changes

- Following the implementation of price changes (most likely at the date when the review of the impact of the price change on performance indicators was defined), the effects of price changes (in the evolution of sales, margin, stock, etc.) and here a new price change cycle can be decided further (where and when necessary).

- Also, deeper understandings can be drawn when analyzing several pice changes for the same SKU over time or even price changes for several SKUs simultaneously.

If desired, the decision to return to the old prices can be automated, without requiring human intervention to return to the prices before the price change.

The QQpricing™ engine shown can be extended in various directions:

- analytics of price elasticity of demand

- management and analysis of the history of price promotions

- extend the definition engine for other promotions, including bundle promotions

- etc.

Average price change per day/ period

If you want the QQpricing™ product, or you want to know more details, please fill in the form here !

For other QQinfo solutions, please visit this page QQsolutions.

In order to be in touch with the latest news in the field, unique solutions explained, but also with our personal perspectives regarding the world of management, data and analytics, we recommend the QQblog !