QQbanking™ provides fast reading plus easy to follow overviews and analytics for all your company’s bank statement of accounts, regardless the number of banks, accounts, currencies, (or even companies) you are operating.

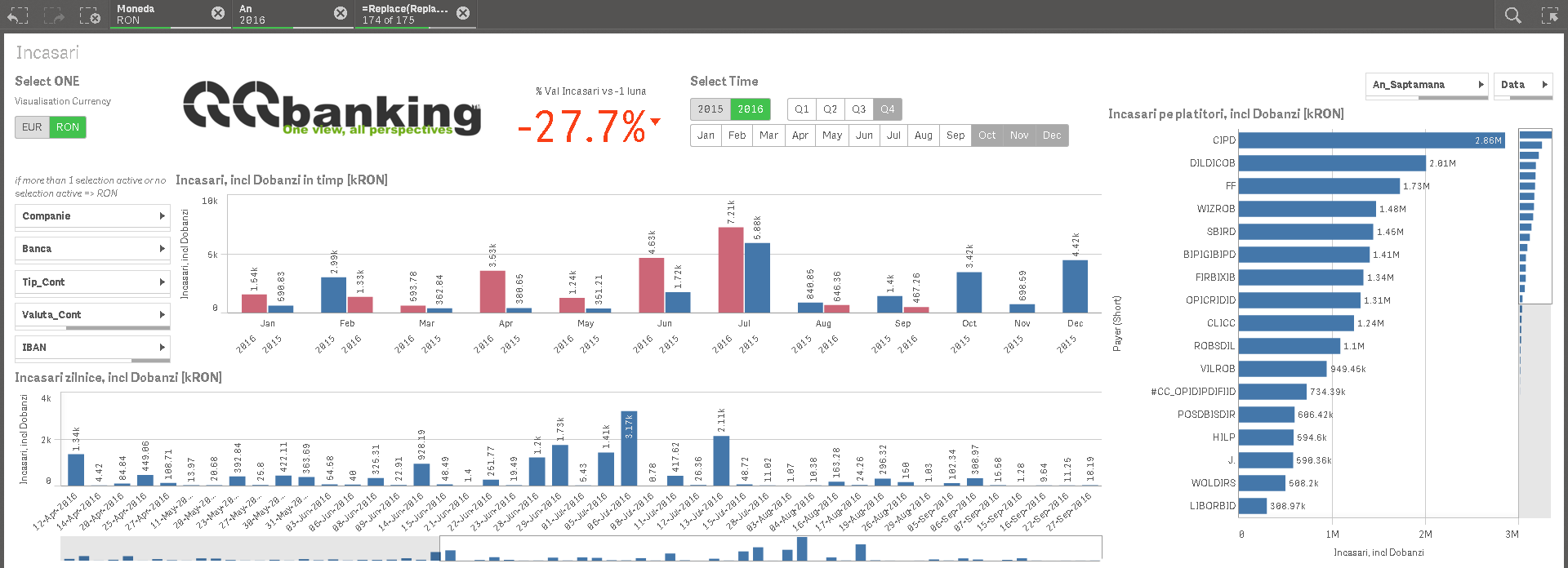

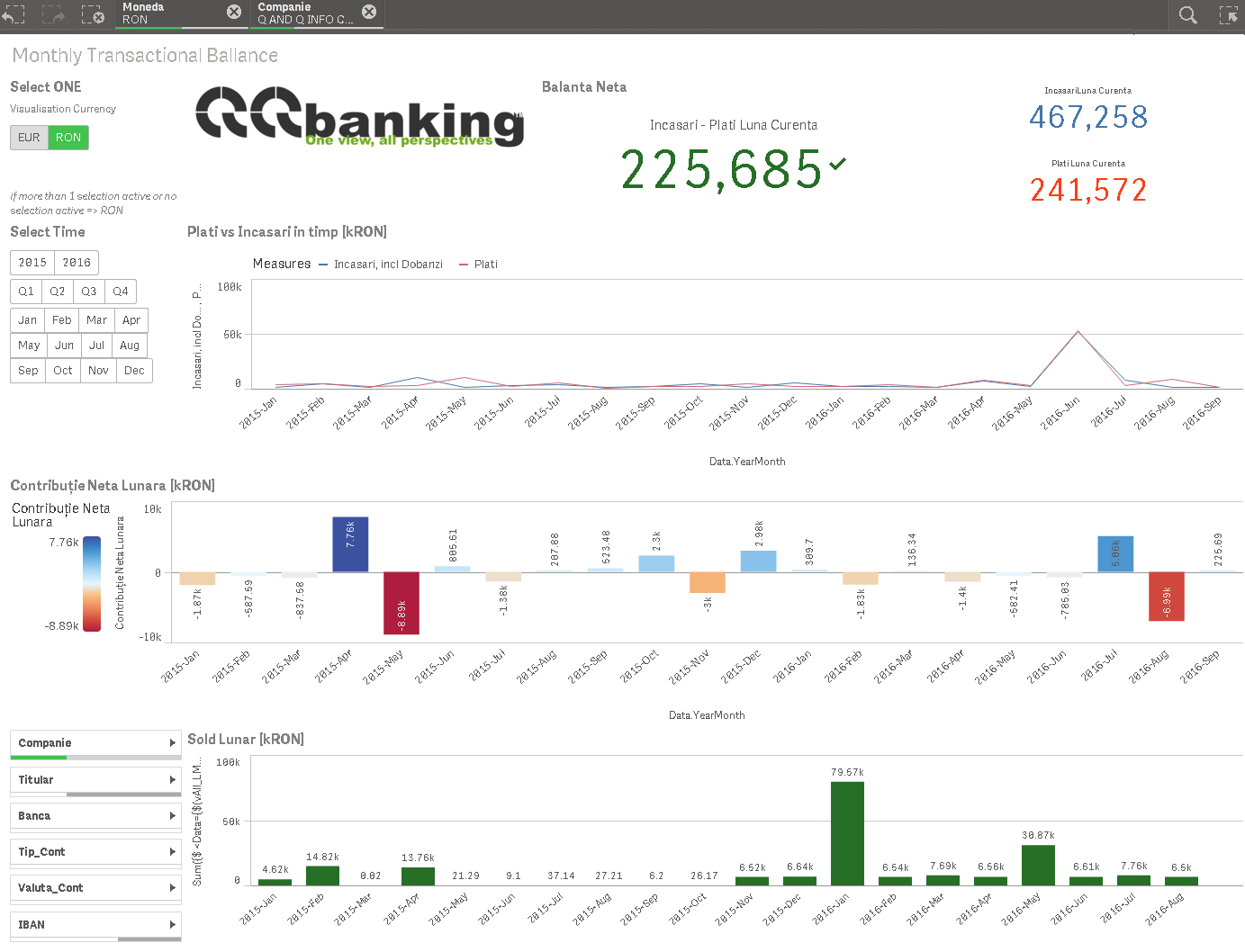

QQbanking™ allows you to view both the current balance and the balance history for any previous period.

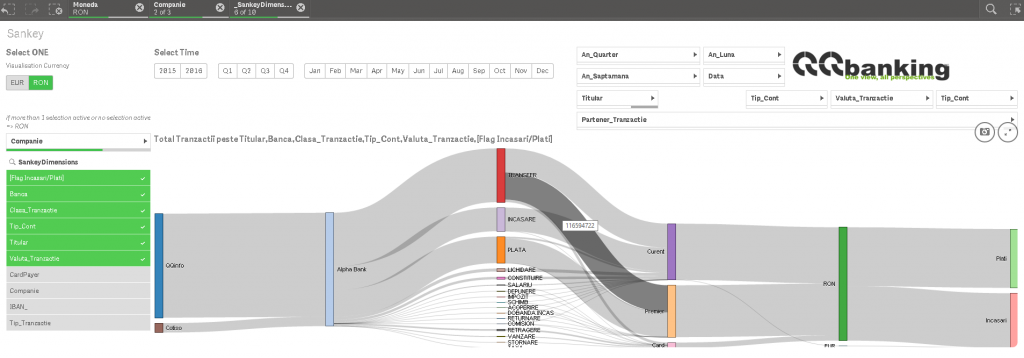

Also, with the help of the solution, you can identify and analyze all types of transactions in acount statements (payments, receipts, commissions, bank transfers, currency exchange, etc.).

For organizations in need of escalating access levels correlated with competency levels, the same application can be transformed automatically, consistently and logically (in terms of both analysis pages and visible data subsets) based on predefined access rules appropriate, on users and roles.

QQbanking™ has just become even more efficient !

Now we can automate the downloading of all files !

The only manual operation that remains to be done is to enter the token from the bank in the internet banking window, immediately after you started your application.

Then QQbanking™ controls both the download of all relevant files and then consolidating them in the visual interface.

And at the end of the above after refereshing the data in Qlik™, we trigger and send a notification email to those interested.

The limited historical time horizon offered today by internet & mobile banking applications can be extended as much as in the past, as long as we have downloaded the information from the past.

Moreover, if you gone through (or will go through) the ”traumas” of changing the internet banking solution offered by any of the banks you work with, we can help you align the data (usually brought in formats significantly different from the 3 platforms), in a single unit view of balance and transactions histories.

The analyzes can be made in value both in transaction currency and expressed in the desired primary analysis currencies, equivalent to the NBR exchange rate on each transaction day or balance.

Changing the view currency can be done with a single click in the navigation interface, all graphs and tables changing virtually instantly to the new view currency.

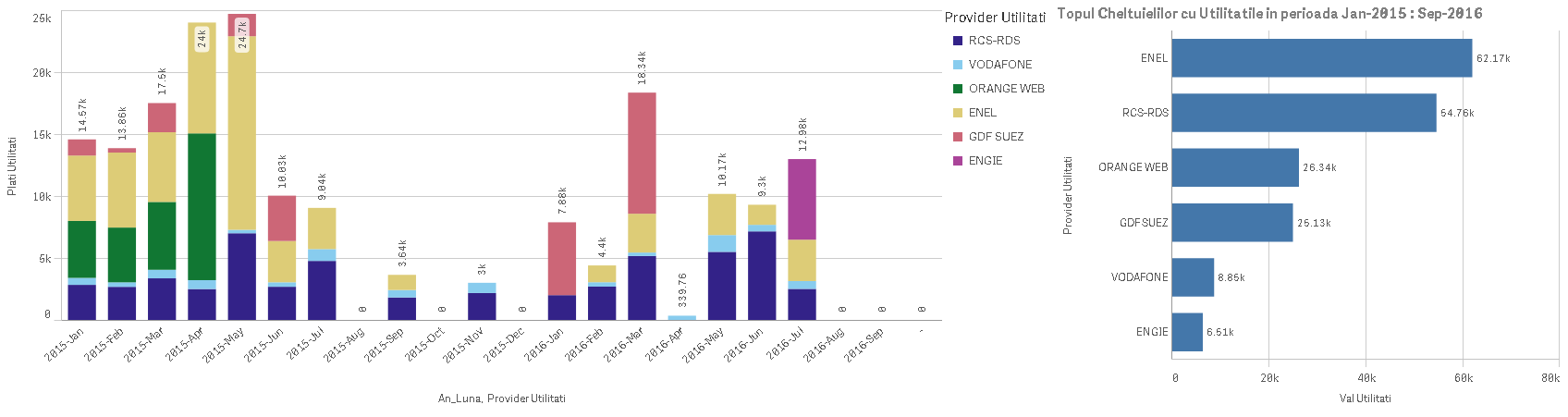

From the above analyses one can immediately understand the importance of spending on various utilities and immediately identify the periods when certain types of payments were skipped.

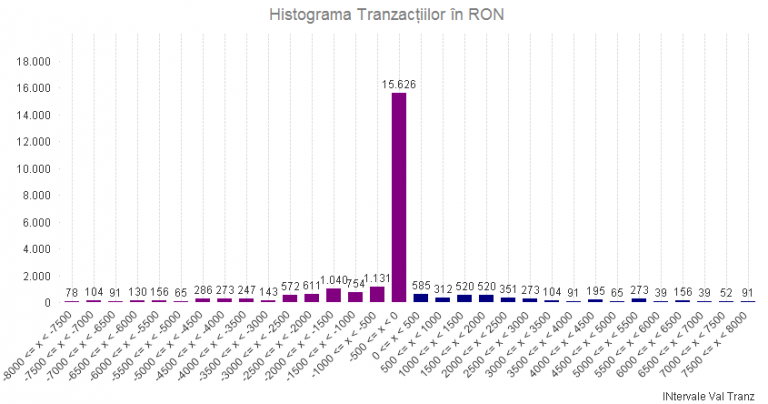

Sometimes even the number counts, not just the value of the transactions.

Not only value analytics are possible, but also numerical analytics (number of transactions, number of partners, number of partners, number of transaction types, etc.), or histogram – type analytics, which identify the distribution of certain transactions by value ranges.

QQbanking™ allows the unification of the method of treatment and coherent visualization of overnight deposits. (Some banks record the establishment of overnight deposits as a ove to a special account, sometimes this is a generic bank account, not one dedicated to each customer. In such situations, the usual statement reading tools record and report the current balance as zero, the value of the overnight deposit ”evaporating” from the balance ratios.).

QQbanking™ offers multi-account, multi-bank and multi-company analysis options, including intr-group consoldation. The analysis of information, but also the filtering can be done on any of the relevant dimensions: banks, currencies, accounts, types of accounts, partner name, company card number, etc..

Absolute Flexibility

You can use as filtering and analytical dimensions all the relevant dimensions: banks, currencies, accounts, companies, partners, card numbers, card owners, etc.

QQbanking™ allows automatic, integrated processing of all statement of accounts from several banks in various currencies from different countries. We recommend to use, as much as possible MT940 (SWIFT) format, but other structured data sources can be used, as well (CSV, MS Excel, etc.).

QQbanking™ can be delivered as a stand alone solution, as a part of QQtreasury™ integrated solution .

QQbanking™ requires one of the QlikView™ or Qlik Sense™ platforms to work.

Starting in 2020, the Qlik Sense Enterprise SaaS™ solution is operational, offering users native access to the Cloud to all possible analytics, from any device (Desktop/ Laptop/ Tablet/ Smartphone).

In addition, the collaborative options offered by Qlik™ plaforms bring remote and time-consuming collaboration to any organization, large or small.

Qlik™ alert mechanisms allow the identification of exceptional situations not only once accessing the Qlik™ analysis platforms and the QQbanking™ application, but anytime and anywhere, via Email or SMS.

For special advanced data processing needs, including using Data Science Machine Learning and Artificial Intelligence tools, Qlik™ solutions offer advanced features, as well as integration with most established Advanced Analytics platforms (R/ Python/ DataRobot).

Once in QQbanking™, the data read from bank account statements can then be integrated into complex data flows and analysis, including payment matching processes on A/R & A/P and automatic import into ERP of statements, even if the ERP does not natively provide such functions, or the successful pairing rates offered by the ERP pairing algorithm is not satisfactory.

For maximum confidence in the analytics provided by the QQinfo team, we have developed a number of additional methodologies and tools that you can learn more about here: QQtrust™.

For information about Qlik™, please visit this site: qlik.com.

For specific and specialized solutions from QQinfo, please visit this page: QQsolutions.

f you are interested in QQbanking™ product, please fill in the form here !

In order to be in touch with the latest news in the field, unique solutions explained, but also with our personal perspectives regarding the world of management, data and analytics, we recommend the

QQblog !