Cash Driver™

is a multi-scenario analysis and future projection tool for fast and interactive analysis of the profitability and availability of Cash Flow of companies and organizations.

In the current economic context, so volatile, determined by Covid, the usual methods of estimating future liquidity, which managers and entrepreneurs usually use, can no longer cope, whether we are talking about the classical Excel files of financial controllers, or the good entrepreneurial sense that “smells” the situations of pressure on the company’s cash flow. This is because, on the one hand, the number of parameters that are no longer constant increases significantly, and on the other hand, new parameters that must be taken into account, appear.

More than the above, considering the unpredictability, even in the short term, of what will happen in the activity of any company, there is an implicit need (underlined by the fact in many webinars and articles published especially recently by to reputable management and entrepreneurship consultants, investors or professors, locally and internationally) to build financial projections in several scenarios and to review these scenarios relatively often in order to anticipate the challenges of the near future and thus to prepare specific courses of action adapted to the identified situations.

Starting from this reality, QQinfo proposes Cash Driver™ for the rapid construction of multi-scenario financial analysis projections, in which the main indicators of profitability and liquidity can be viewed in a graphical, intuitive and contextualized way, (exemplified and highlighted in the figure below).

Cash Driver™ Benefits

- You can start from the classical budgeting on revenues and expenditures, with some additional details on average VAT rates.

- Uses a template in a popular spreadsheet format XLSX (Microsoft Excel), easy-to-use, to enter data and define scenarios.

- The system allows the control of each important parameter at the level of the calendar month (including the specific gaps of certain types of financial records, even in fractions of a month, depending on the average payment terms specified in the scenario entry file).

- Unexpected scenario modeling flexibility in classical P&L and CashFlow projection approaches.

- Additional extra-dimensional refinements can be added immediately, on Business Units or by adding additional chapters to break down revenues, expenses, receipts and payments.

- The processing time is in the order of seconds or minutes, including here the correspondence with the Cash Driver™ processing server located at QQinfo.

- All processing is consistent, systematic, performed automatically, eliminating the risk of Spaghetti formulas in Excel and human errors.

- Automatic reconfiguration of data reading for more sophisticated situations, does not require recovery interventions in processing or interface, only adds additional rows with specific properties in the already sent model files.

- “Graphics first” representation, with immediate navigation options in pivot tables, for details.

- Waterfall graphical representation for Profit & Loss visual synthesis.

- Multiple reporting perspectives for different needs or different destinations available in one place, one click away, or in direct comparison visualizations.

- Options for choosing the relevant budget scenario.

- Immediate visual comparison between different scenarios, but also between versions, or business units.

- P&L Reports + CF (indirect) + Stocks in the same place, with relevant selections interconnected, where needed (time/ branch/ time perspective/ analysis version/ data generation/ scenario/ etc.).

- There are several checks and alerts on data quality (both in Qlik and Excel), which allow quick identification of some of the possible errors in defining scenarios.

How Cash Driver™ Works

Cash Driver™ works in 3 simple steps:

Cash Driver™ uses a spreadsheet file, ready prepared in a popular format, easy to understand and process (XLSX = Microsoft Excel Spreadsheet) in which the departure information of profitability projections can be loaded (P&L = Profit & Loss = profit account and losses), some additional details that affect the company’s cash flow, such as acquisitions, but also the amount of cash or payables and receivables, inherited from periods prior to the analysis period. It adds to the same file information about the variants of specific payment and collection terms, as well as what decisions to reduce staff costs (unpaid leave, technical unemployment) are considered in each scenario.

The way in which the entire analysis and projection system was built allows the control of each important parameter at the level of the calendar month (including the specific gaps of certain types of financial records, even in fractions of a month, depending on the average payment terms specified in the file). introduction of scenarios). This approach allows for scenario modeling flexibility unprecedented in the classic P&L and CashFlow projection approaches.

Note: To edit the script file, you need a Microsoft Excel version (since 2007), or a spreadsheet editor that will import the model file in XLSX format and save it back in this format before by sending the file with the data entered for processing.

The rest of the processing of this data is no longer in the care of the user/ analyst, being taken over by the Cash Driver™ calculation engine, which takes care of the placement in the right month of cash flow of all the specified information. The same calculation engine also estimates the values and terms of payment/ collection for VAT, taxes on profit or income micro-enterprise, taxes on salaries, state benefits for technical unemployment, considering the decisions to reduce salary expenses related to each scenario.

Note: In the current version, sending the file for processing is done by attaching the XLSX file to an email sent to a QQinfo email address. And the file with the result of the processing is also returned by email.

Post procesare, rezultatele sunt aduse într-o interfață Qlik™ grafică și tabelară, dinamică, comparativă și interactivă, care evidențiază imediat, grafic, cu comparație vizuală imediată dintre scenarii:

- the evolution of monthly profit

- the evolution of monthly monetary profit (free cash flow net per month)

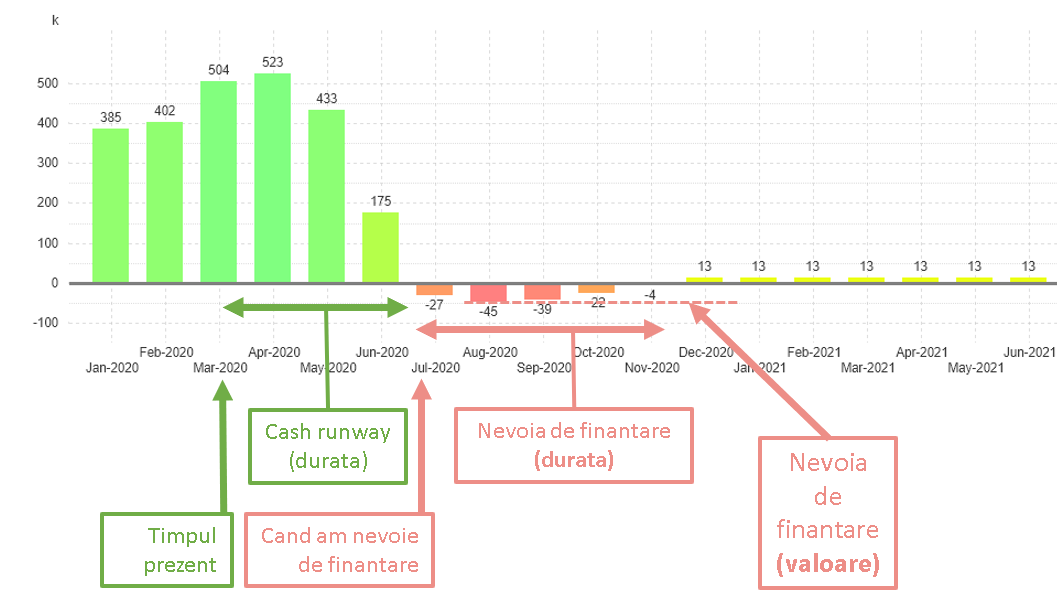

- cash runway (see in the bibliography the references from Marius Ghenea – in Romanian)

- the resulting need for funding (as timing, duration, and value)

Note: To use visual analysis, an installation of the Qlik™ Business Intelligence application is used (optional between QlikView™ and Qlik Sense™).

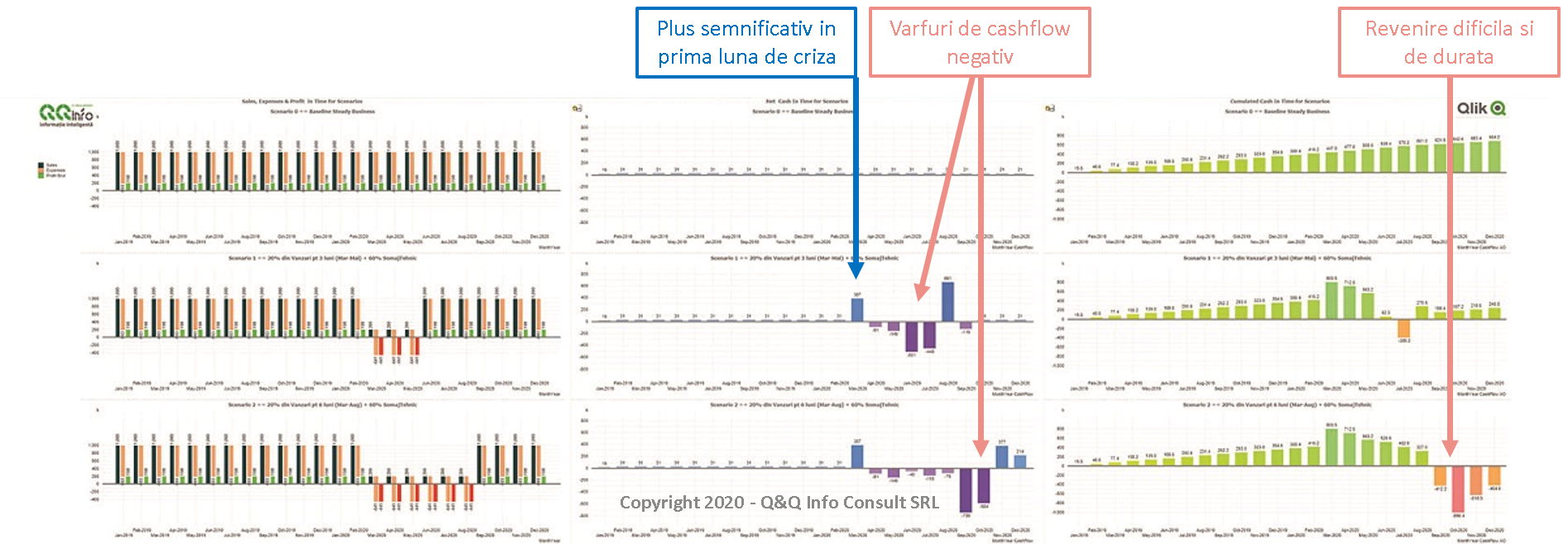

The comparative graphical visualization is as explicit as possible!

It is highlighted in this example of scenarios:

- în cash in the first month of the crisis a significant, rather unexpected, increase in cash

- at the end of the crisis, in the first 2 months of “recovery” there are 2 months with a strong negative impact on cash flow

- the last scenario shows an extremely difficult return of liquidity

Of course, after this first processing, immediately, or when the known forecast data changes, the process can be resumed, to build new variants of scenarios. The view engine combines all the previously created scenarios, giving you the option to compare literally anything with anything.

Pricing Cash Driver™

Following additional consultations with some of the potential beneficiaries, we adjusted the pricing policy to a more than reasonable one, in which we positioned the price of a one-month subscription with an unlimited number of processing significantly below the cost of one working day to build a scenario (especially since the added value brought by Cash Driver™, through the ease of analysis, the calculation speed and the focus left on the thinking of the scenarios and their analysis, is significantly higher than the cost related to the manual or automatic process).

Thus, we offer you three subscriptions – BASIC, PRO or ENTERPRISE – and 3 options for the contracting period (MONTHLY subscription, for 1 YEAR or for 3 YEARS).

More details about the price options and subscriptions offered can be found here (in Romanian language).

To access Cash Driver™ please register by filling out the form here (in Romanian language).

(You will receive the upload and use instructions later on – in Romanian language).

You can choose for the ”first month free trial” package in the form !

Testimonials (in Romanian language) about Cash Driver™ from:

Cătălin Anghel, Director Marketing – ROMSTAL

În prima lună de criză, am reușit să construim de 2 ori scenarii de proiecții financiare, cam 1 dată la 3 săptămâni. Procesul a durat mai bine de 1 zi, a fost realizat de unul dintre analiștii noștri financiari de top în mai mult de 1 zi de lucru și flexibIlitatea de a reface vreunul dintre scenarii cu ușoare modificări de parametri nu este deloc la îndemână.

Cash Driver™ ne permite să avem noi scenarii procesate în câteva minute. În loc de circa 1 zi, acum avem o nouă analiză gata în câteva minute, în plus am eliminat riscurile specifice formulelor ”spaghetti” din Excel și putem compara totul mult mai ușor, vizual, pe grafice intuitive.

Putem astfel revedea proiecțiile de cash flow săptămânal, așa cum ne-am dorit, sau ori de câte ori schimbarea condițiilor legislative sau de altă natură o impune.

Marius Ghenea, Partener – CATALYST ROMANIA

În ziua în care, invitat de Business Days, am ținut un webinar despre importanța înțelegerii conceptului de Cash Runway pentru orice companie în situații de criză ca cea actuală, echipa QQinfo mi-a prezentat prototipul Cash Driver™. Este cel mai flexibil și rapid mod prin care se pot face proiecții de cash flow și profitabilitate, pe care l-am întâlnit până acum. Sunt convins că este o unealtă relevantă în orice moment, dar în aceste vremuri este o unealtă esențială de supraviețuire.

Țin să subliniez și confirmarea previziunii făcută de mine în timpul webinar-ului, legată de riscurile majore ce pot apărea în cash flow-ul companiilor nu în timpul crizei, ci chiar în momentul ieșirii din criză, confirmare documentată temeinic, pe scenarii multiple, de echipa QQinfo cu ajutorul Cash Driver™.

Laurențiu Tigaeru Roșca, Partener – QUASAR COMEX

Am apreciat, încă de la începutul colaborării noastre, modul în care QQinfo gândește utilitatea imediată a uneltelor de analiză pe care le construiește, și am avut numeroase momente în care mi-am spus “Băi ce tare e BI-ul ăsta!”

Dar când am văzut Cash Driver™, am rămas fără cuvinte, pentru că răspundea exact la preocupările mele din săptămâna respectivă, legate de construirea de scenarii variate de evoluție a companiei mele în perioada următoare, atât ca profitabilitate, cât mai ales ca și cash flow. Iar la validarea pe variația în timp a valorii stocului nici măcar nu mă gândisem și Cash Driver™ o are deja.

În plus, pricing-ul flexibil pe care îl oferă nu îmi dă nicio scuză să nu folosesc această unealtă managerială de top.

Ovidiu Dâmbean – Creța, Profesor universitar doctor, Rector – ASEBUSS

Cash Driver™ mi-a oferit simultan mai multe satisfacții:

1. Faptul că un student de-al meu a construit acest instrument spectaculos de modelare economică.

2. Utilitatea oferită este remarcabilă, în special în contextul crizei Covid, prin flexibilitatea modelării întârzierilor la decontare (deși eu cred că acest instrument este foarte util și oportun și în perioade din afara crizei).

3. Șansa de a fi contribuit la denumirea aplicației, deci de a fi oarecum chiar ”nașul” soluției 🙂.

Recomand Cash Driver™ oricărei companii, manager sau antreprenor, atât pe timp de criză, cât și în afara ei, și mă bucur că voi putea să folosesc și eu acest instrument la cursurile mele de Financial Management, pentru a explica mai ușor interdependența dintre Contul de P&L și cash flow.”

Gabriel Tălpigă, Director Marketing & Clienți – VALROM INDUSTRIES

QQinfo mi-a propus Cash Driver™ exact în momentul în care urmăream un webinar susținut de o echipă de consultanți financiari internaționali de top, pe tema necesității construirii de scenarii multiple de cash flow. Când am auzit că deja QQinfo are prototipul funcțional nu am putut să zic decât “Vreau!”

Bibliography:

- Webinar Business Days cu Marius Ghenea – Cash Runway for the crisis period – YouTube (in Romanian language)

- McKinsey – Covid 19 – Implications for business

- Iancu Guda – How to prepare for recession – 5 cash flow measures for entrepreneurs (in Romanian language)

- Harvard Business Review – Living in the Futures

- McKinsey – The Use & Abuse of Scenarios

Cash Driver™ Terms (in Romanian language): https://qqinfo.ro/conditii-cash-driver/

GDPR Cash Driver™ (in Romanian language): https://qqinfo.ro/gdpr-cash-driver/

Cash Driver™ Privacy (in Romanian language): https://qqinfo.ro/confidentialitate-cash-driver/