How can SAF-T be generated ?

- Manually

• regulations allow it, but it is difficult to generate

• it will be cumbersome for companies with few registrations per month

• and virtually impossible for anything larger than that

- Export directly from ERP to SAF-T.XML

possible, if the ERP platform provider has prepared the functionality (or if we have a mixed and capable IT team) - Export from ERP to Excel/ CSV and from there reprocessed and exported to SAF-T.XML

This solution is usually proposed by tax consultants, including Big4) - With a dedicated, custom-made tool made by a B2B software company

- With a dedicated integrated SAF-T tool

Such solutions, usually using a Data Integration & Visual Analytics (Business Intelligence) platform, offer extensive facilities, an integrated, auditable, trackable, and fully automated workflow.

Who can help us with SAF-T ?

Internal IT team

- Dedicated, including for multiple, perhaps heterogeneous sources

- Risky (it's a one-off project, probably under-tested)

- Solves only part of the needs

ERP provider

- Cheap

- Dedicated to own ERP only

- Inflexible

- Solves only part of the needs

Tax consultant

- More secure

- Expensive

- Solves only part of the needs

B2B soft company

- More secure

- Expensive

- Difficult to change afterwards

- Solving only part of the needs

Experts in integrated data processing

- The most secure

- Most flexible

- Cheapest (TCO)

- Handles the entire process, including verification of imported data and reporting

- Fully automated (only relevant tasks are left to the human operator)

- Transparent access provided immediately to management to current and historical reporting status

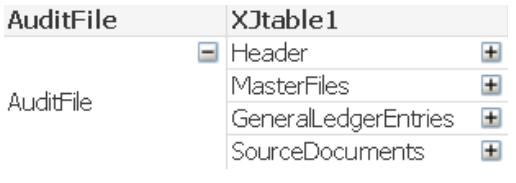

SAF-T data structures (XML)

4 Sections

- A 10-level hierarchy with 820 fields, of which 386 fields are mandatory.

- When broken down to the level of 1 entity on 1 row, you get, for a demonstration data model with a few invoices and accounting notes, a file with only… 1200 rows!

Header

Section 1

- Mandatory in all reports or reporting segments;

- Contains the identification of the taxpayer (CUI) and the type of accounting records kept, as well as an extensive set of identifiers, including the reporting period;

- A 7-level hierarchy with 55 fields, of which 27 are mandatory.

Master Files

Section 2

- It contains, among other things, nomenclatures and balances on the most important data sets in the management and accounting of a taxpaying legal person:

Dictionary

- Products

- Customers

- Suppliers

- Fixed Assets

+ Balances

- Opening and closing balances on all synthetic accounts (referred to as “SAF-T analytical”)

- Detailed stocks by item

- A 7-level hierarchy with 55 fields, of which 27 are mandatory.

General Ledger

Section 3

- Contains the accounting journal register at accounting note line level, detailed on all summary accounts in classes 1 to 7

- A 9-level hierarchy with 51 fields, of which 36 are mandatory.

Source Documents

Section 4

- Contains transaction line level details for a company’s main financial-accounting facts:

• Sales invoices

• Purchase invoices

• Stock movements

• Settlements (Payments and Receipts)

• Fixed assets movements - A 10-level hierarchy with 474 fields, of which 186 are mandatory.

More details about QQinfo‘s SAF-T solution can be found here aici: Qsaft™

For information about Qlik™, please visit this site: qlik.com.

For specific and specialized solutions from QQinfo, please visit this page: QQsolutions.

In order to be in touch with the latest news in the field, unique solutions explained, but also with our personal perspectives regarding the world of management, data and analytics, we recommend the QQblog !