macroEQ™ – dynamic multidimensional analysis over Romania’s macroeconomic information.

macroEQ™ contains and presents consolidated and dynamic information about Romania’s macroeconomics (Correlation of varied information, inflation, interest rates, stock indices, internal and external debt rates, Current Course variation, Course variation in Time, etc.).

Among the main benefits of the macroEQ™ solution are:

- It eliminates multiple introduction of the same information manually and offers:

- an increased processing speed;

- staff download;

- human errors elimination.

- Ensures a quick, consistent and no errors processing;

- Highlights the shortcomings in data quality (generates reports and/or alerts for all predictable mismatch situations);

- Offers rapid, complete, interactive and friendly access to synthesis and detailed information based solely on information and processing executed automatically ensuring transparency and verisimilitude;

- Ensures a complex and objective processing for identifying the situations that need the manager's/operator's intervention;

- All the information is presented mainly through graphs.

The macroEQ™ application uses consolidated free public data from the following sources:

- National Bank of Romania (http://www.bnr.ro);

- Bucharest Stock Exchange (http://bvb.ro);

- Qlik Data Market (http://www.qlik.com/us/explore/products/qlikdatamarket).

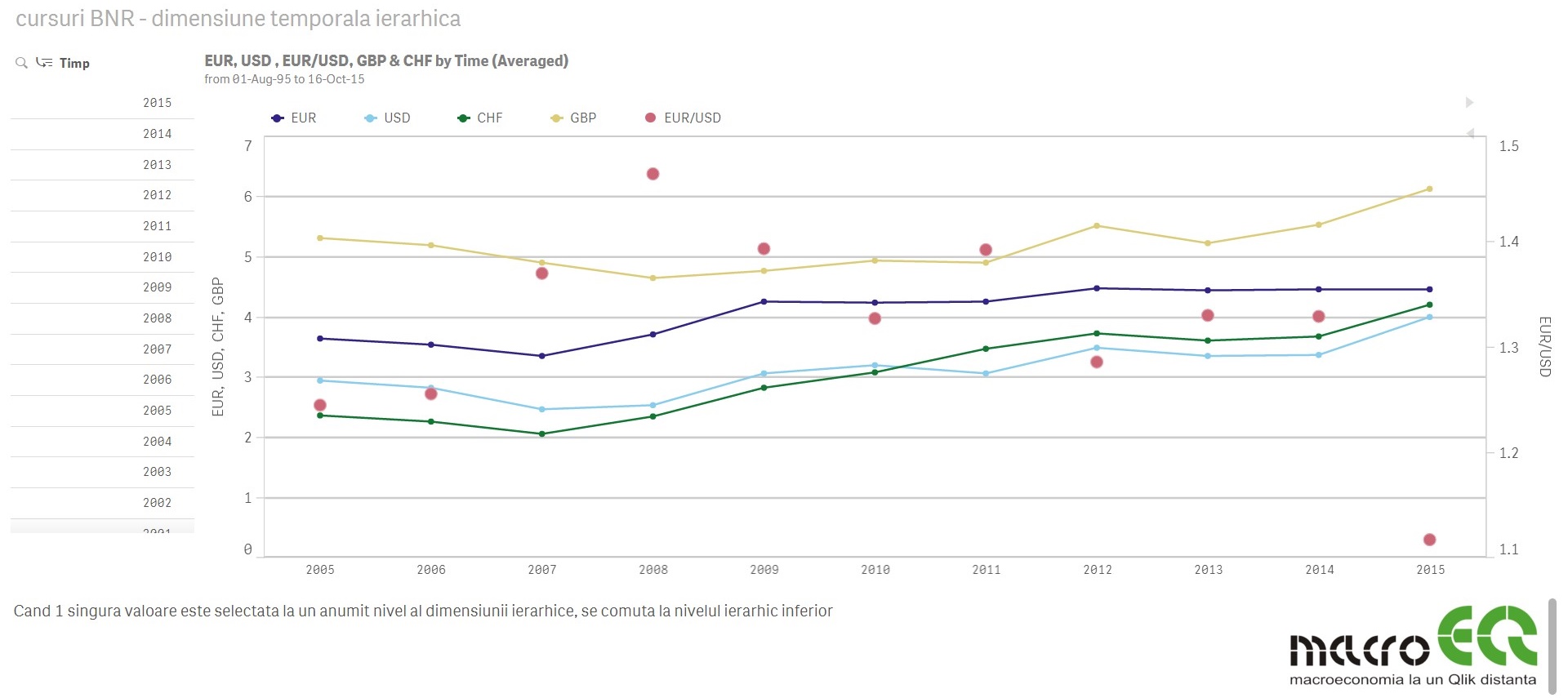

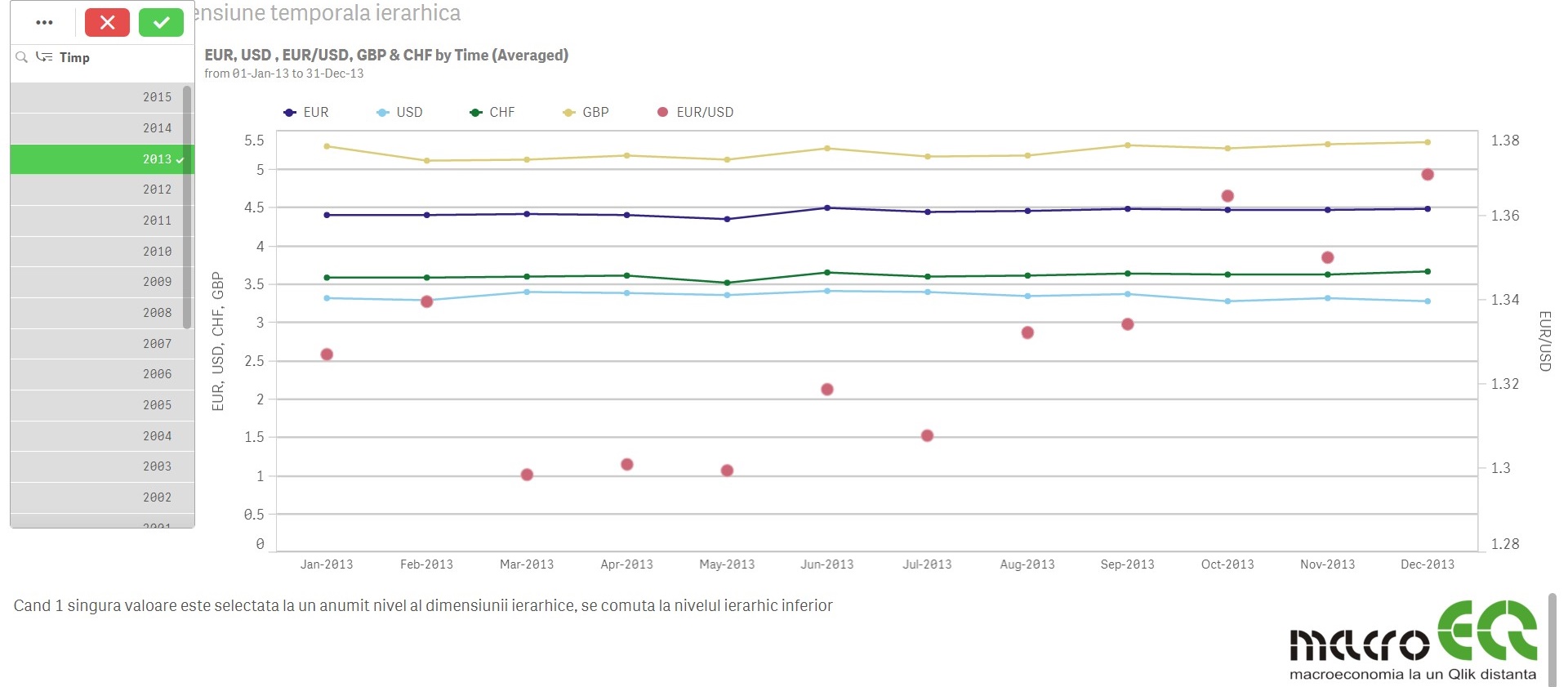

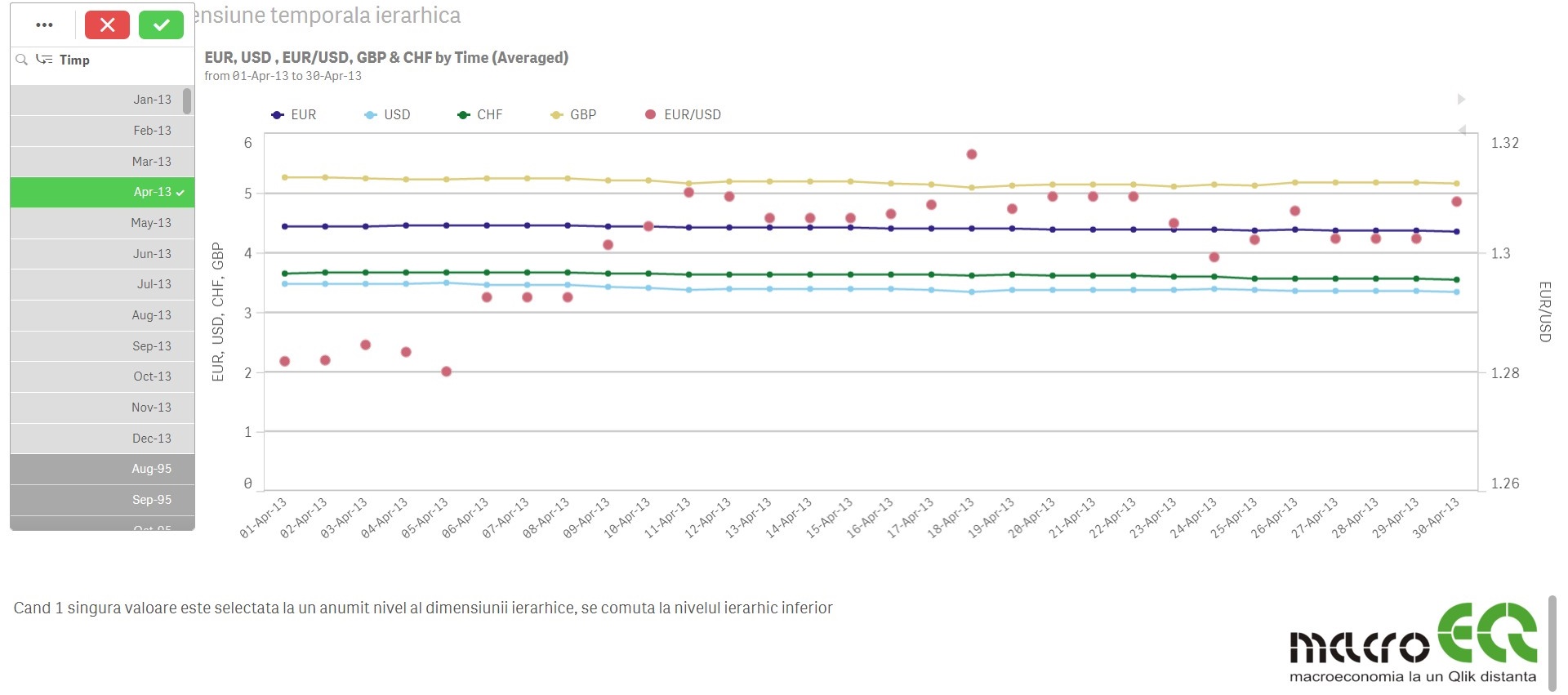

An example of an application that was made using macroEQ is the one about currency exchange rates. In this application you can view the following:

A. The evolution of the main currencies over time (RON, EUR, USD, CHF, GBP);

Initially, the graph shows the averages of these currencies (RON, EUR, USD, CHF, GBP) per years.

By selecting a year, from the left side of the view (in the example above, 2013 was selected), this average is recalculated at month level, and if one month is selected (also on the left side of the view) Could view the exchange rates of each day of that month (as can be seen in the picture below).

B. The parity between different currencies, for the current date, with the possibility of recalculation for another selected date.

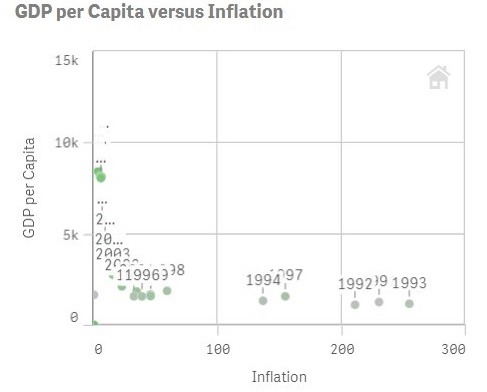

C. Situations that show the evolution of income per capita over a period of time, the evolution of inflation and unemployment.